We provide ongoing tax-efficient retirement planning and investment management.

The creation of your comprehensive financial plan, the roadmap for your financial future, is the starting point of our ongoing relationship.

After completion of your initial plan, we'll work closely with you throughout our relationship. Typical areas in which we provide ongoing advice are:

- Portfolio allocation with a focus on risk-adjusted returns

- Building projections for retirement and other important goals

- Lifetime tax minimization strategies (often using Roth conversions)

- Reviewing your insurance policies for family risk management (life, disability, LTC)

- Designing tax-efficient withdrawal strategies for retirement income

- Working with you to decide when is best to claim Social Security

- Reviewing your estate planning documents or helping you put these in place

- And more

Financial planning is best as an ongoing process, not a product. The ultimate goal is for us to help you make the best possible decisions around your finances to allow you to live your best possible retirement!

After the initial plan is created, we will typically have two or three formal meetings per year to update your plan, refine your portfolio withdrawal strategy, determine each year’s tax planning objectives and actions, review estate plans and wishes, discuss any questions you have, and more. While we plan on two or three formal review meetings per year, we are accessible by Zoom, in-person meetings, phone, or e-mail as life unfolds and financial decisions need to be made.

Additionally, you’ll have access to your own personal finance portal through RightCapital, our financial planning software. Your portal allows you to aggregate info from all of your banking, investment, and lending accounts into one single view. You’ll be able to see and track your net worth, investment holdings, cash flow projections, and various other financial reports.

We'll also provide ongoing discretionary management of your investable assets, through accounts held in custody at Charles Schwab.

Without Behl Wealth

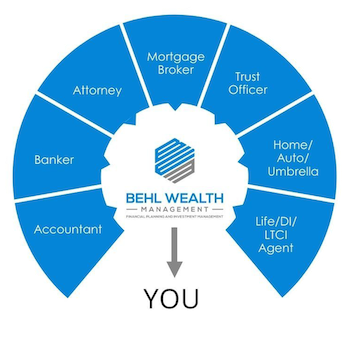

We Believe in Coordination

Without Behl Wealth Management, you are the point of contact with each of your advisors. Often, no coordinated strategy exists, sometimes resulting in conflicts or delays in achieving your goals.

We can be your financial planner and financial advisor — including 401(k) asset allocation. We will coordinate your strategic plan with your team of advisors so everyone is working together towards achieving your goals and objectives — you now only need to coordinate with us.

With Behl Wealth

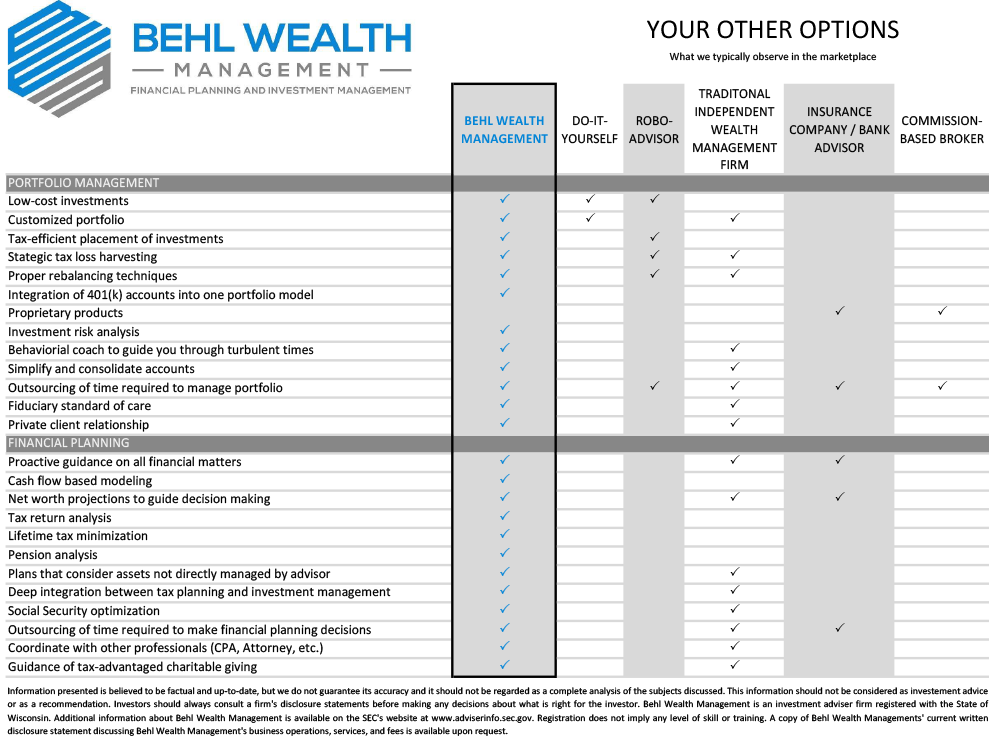

How We Compare